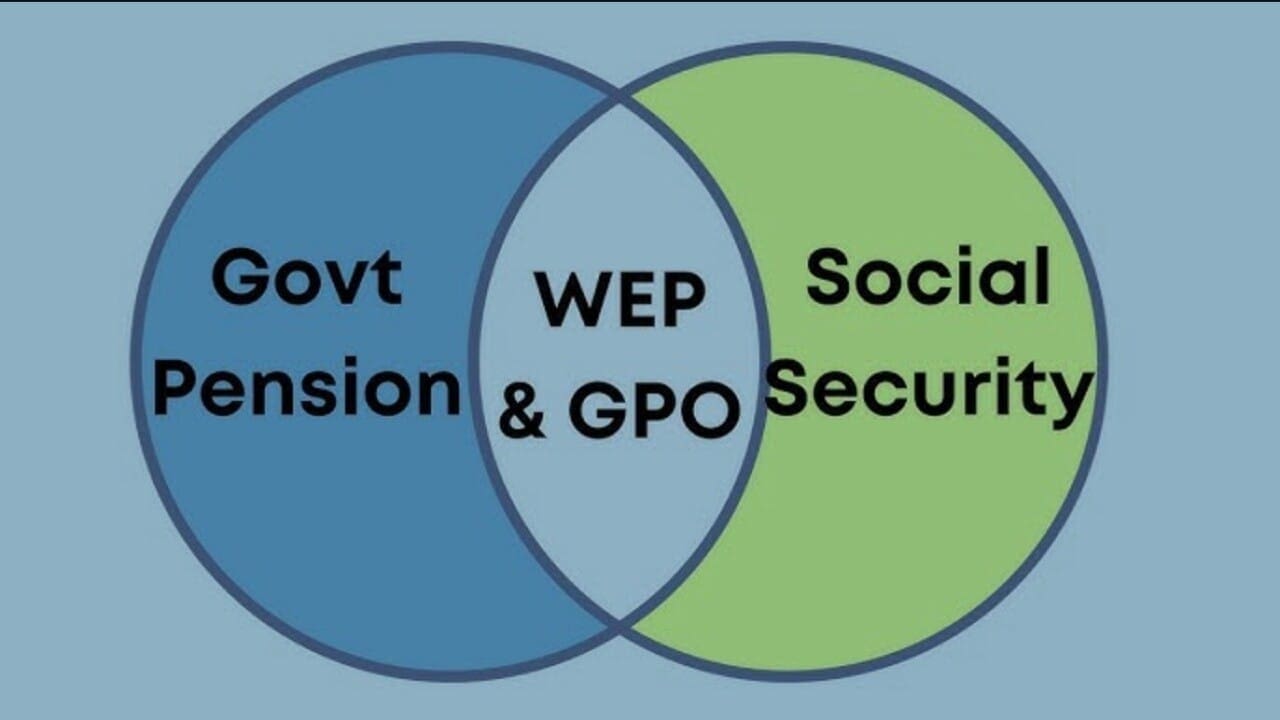

The Social Security Fairness Act would repeal the so-called “government pensions offset,” or GPO, which reduces Social Security spousal or widow(er) benefits for those who receive noncovered pensions, according to the Social Security Administration’s website.

The summary also says the bill also eliminates the so-called “windfall elimination provision” that “in some instances reduces Social Security benefits for individuals who also receive a pension or disability benefit from an employer that did not withhold Social Security taxes.”

Such pensions are paid by employers — typically, state and local governments or non-U.S. employers — that do not withhold Social Security taxes from employee salaries.

HAPPENING TODAY: House of Representatives Expected to Vote on the

The APWU has never stopped fighting to pass the Social Security Fairness Act (H.R. 82), and today is a critical moment for us. This bill would repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) – two unfair parts of Social Security law that reduce or even eliminate Social Security benefits for millions of postal and federal annuitants. The GPO and WEP penalize CSRS retirees who have paid their fair share into Social Security and meet the requirements for benefits.

H.R. 82 vote scheduled; ask your representative to vote yes

Contact your representative through NALC’s Legislative Action Center, or call (202) 224-3121.

ACTION ALERT: The Social Security Fairness Act is Scheduled for a Vote TODAY!

H.R. 82, the Social Security Fairness Act, is scheduled for a vote THIS evening, November 12. Contact your representative ASAP and ask them to vote “Yes” on H.R. 82.

Add your first comment to this post