Federal employees overwhelmingly pay their taxes and do so on time, but the Internal Revenue Service’s watchdog wants to see a significant uptick in enforcement on the growing minority of delinquent civil servants.

Just 5% of current federal workers owed the IRS money or did not file their taxes in 2021, according to a new report from the agency’s inspector general, up from 3% in 2014 and 4% in 2015. The number of tax delinquent feds jumped by 32% between fiscal years 2015 and 2021, however, while their collective debt rose by 36% to $1.5 billion. More than 1,000 of the nearly 150,000 feds who owed taxes were delinquent for six years or longer.

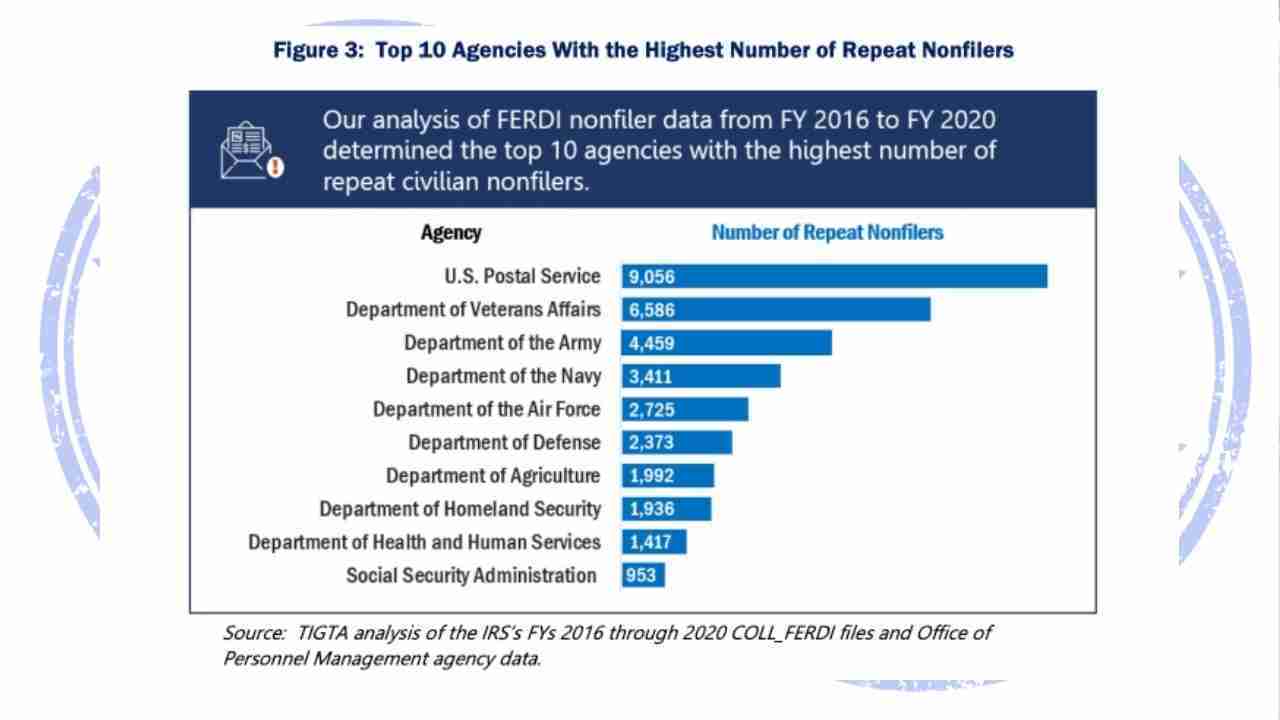

Of the top 10, the U. S. Postal Service, the Department of Veterans Affairs, and the Department of the Army had the highest rates of repeat nonfilers. Our analysis also found that many of these employees are also high-income nonfilers. For purposes of nonfiler compliance, the IRS defines high-income nonfilers as those taxpayers with total positive income of $100,000 or more.17 Total positive income is the sum of all positive amounts shown for the various sources of income reported on an individual income tax return and, therefore, does not include deductions or tax credits. Because there is not a simple way to identify total positive income on an unfiled return, we estimated the income for these repeat nonfilers using various sources