- By law, the Postal Service’s retiree assets are invested exclusively in U.S. Treasury securities, which pose little risk and generate low investment returns. If the Postal Service wanted to invest in other assets, congressional action would be required.

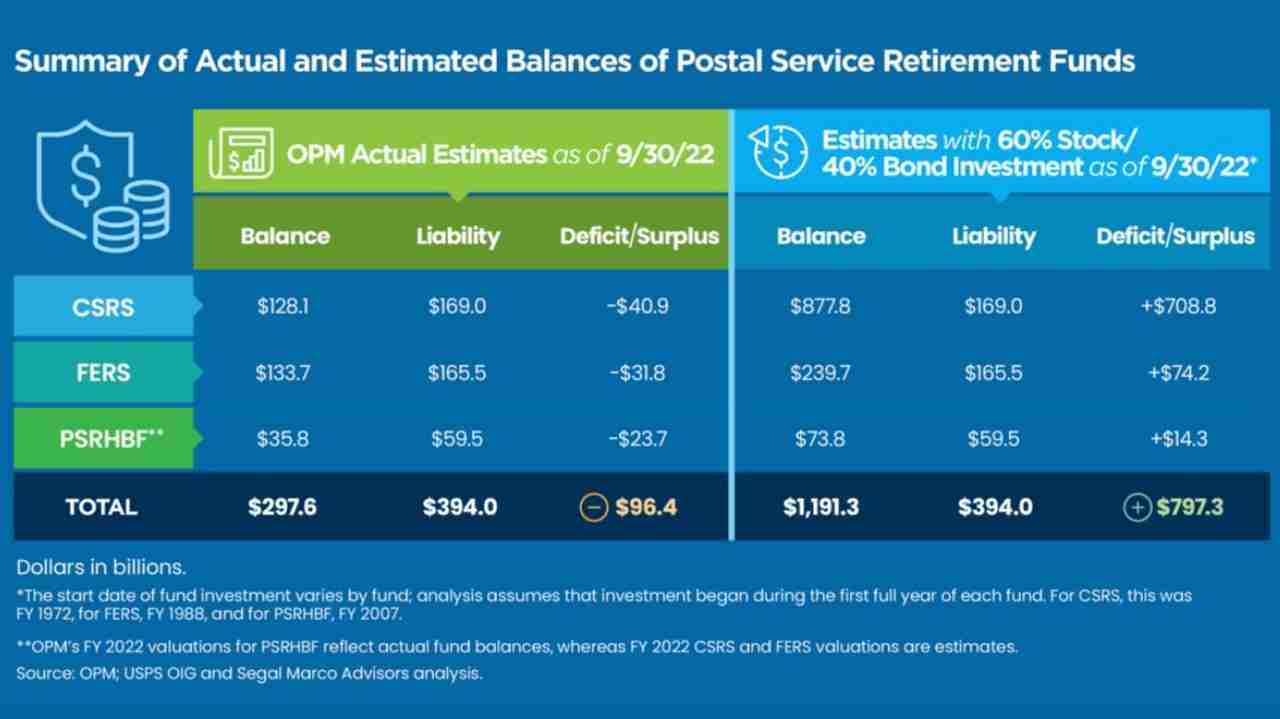

- An OIG analysis found the Postal Service could have had $1.2 trillion in retirement assets at the end of fiscal year (FY) 2022, had it invested retirement funds in a mix of 60 percent stocks and 40 percent bonds.

- The Postal Service’s strategy is not the norm in state, local, and private pension funds, which are typically invested in a diversified mix of stocks, bonds, and other assets. There are also federal examples of more diversified investments.

- Generating higher returns could free up money to invest in the processing and delivery network, strengthen the workforce, and minimize price increases.

The Postal Service’s retiree assets are, by law, invested exclusively in U.S. Treasury securities. These investments are low-risk and generate low investment returns compared to other types of investments, like stocks. This investment strategy is not typical for defined benefit pension funds. The USPS OIG’s research showed fund diversification is standard in pension funds for state and local government workers and in the private sector. There are also federal examples of more diversified investments.

Between the three retirement programs — the Civil Service Retirement Fund (CSRS), the Federal Employees Retirement System (FERS), and the Postal Service Retiree Health Benefits Fund (PSRHBF) — the Postal Service could have had $1.2 trillion in retiree assets at the end of FY 2022, had the agency invested in U.S. stocks and bonds. Instead, OPM estimates the actual value of USPS’ three retirement programs to be $298 billion at the end of FY 2022.